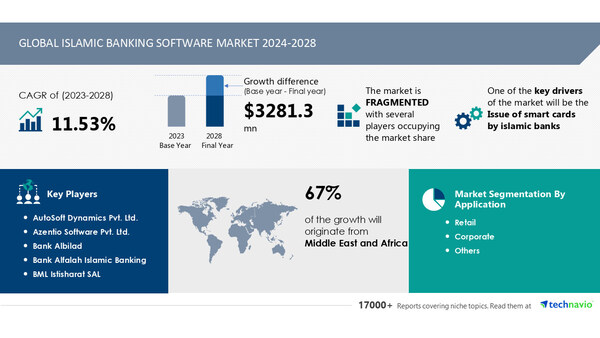

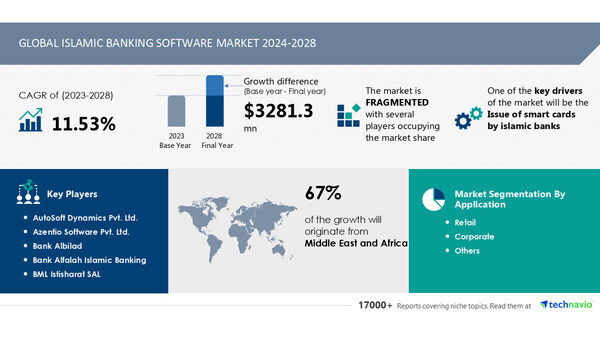

The global islamic banking software market size is estimated to grow by USD 3.28 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 11.53% during the forecast period. Issue of smart cards by islamic banks is driving market growth, with a trend towards adoption of blockchain technology. However, lack of expertise, awareness and training in islamic banking software poses a challenge. Key market players include AutoSoft Dynamics Pvt. Ltd., Azentio Software Pvt. Ltd., Bank Albilad, Bank Alfalah Islamic Banking, BML Istisharat SAL, Codebase Technologies FZE, Craft Silicon Ltd., First Abu Dhabi Bank PJSC, ICS Financial Systems Ltd., INFOPRO Sdn Bhd, Infosys Ltd., International Turnkey Systems Group, Millennium Information Solution Ltd., Nucleus Software Exports Ltd., Oracle Corp., Sopra Steria Group SA, Tata Consultancy Services Ltd., Temenos AG, and Virmati Infotech Pvt. Ltd..

Get a detailed analysis on regions, market segments, customer landscape, and companies- View the snapshot of this report

|

Islamic Banking Software Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 – 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.53% |

|

Market growth 2024-2028 |

USD 3281.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

10.45 |

|

Regional analysis |

Middle East and Africa, APAC, Europe, North America, and South America |

|

Performing market contribution |

Middle East and Africa at 67% |

|

Key countries |

Saudi Arabia, Malaysia, United Arab Emirates, Kuwait, and Qatar |

|

Key companies profiled |

AutoSoft Dynamics Pvt. Ltd., Azentio Software Pvt. Ltd., Bank Albilad, Bank Alfalah Islamic Banking, BML Istisharat SAL, Codebase Technologies FZE, Craft Silicon Ltd., First Abu Dhabi Bank PJSC, ICS Financial Systems Ltd., INFOPRO Sdn Bhd, Infosys Ltd., International Turnkey Systems Group, Millennium Information Solution Ltd., Nucleus Software Exports Ltd., Oracle Corp., Sopra Steria Group SA, Tata Consultancy Services Ltd., Temenos AG, and Virmati Infotech Pvt. Ltd. |

Market Driver

The Islamic banking industry is experiencing digital transformation, driven by the adoption of blockchain technology, IoT, and supply chain analytics. This technological shift is particularly noticeable in industry verticals like BFSI and manufacturing. Blockchain enables real-time tracking of end-to-end transactions, using technologies like Smart Contracts for seamless online transactions. Cloud computing solutions facilitate IoT implementation, allowing manufacturers to connect sensors and devices, reducing per-person access costs, and fostering collaboration with suppliers and customers. The flexibility and rapidly changing technology landscape are expected to increase demand for hosted and cloud-based solutions in the Islamic banking software market.

The Islamic banking software market is experiencing significant trends in the banking industry. With industry saturation, fintech upheaval, and increasing regulatory initiatives, Islamic banks and financial institutions are seeking efficient and compliant solutions for their operations. On-premises and cloud-based solutions are popular choices, with hybrid options also gaining traction. Islamic finance institutions catering to large enterprises, mid-sized companies, retail sector, SMEs, and large corporations are integrating smart cards, sukuk issuances, and automation into their processes. Fintech companies and software providers are offering cloud-based solutions, incorporating artificial intelligence, blockchain technology, and cloud computing. Sharia compliance, risk administration, analytics and reporting, asset administration, and cellular banking are key features in demand. Integration skills, data protection, cybersecurity, sustainability, and moral investing are essential considerations. Fintech partnerships are crucial for enhancing services, ensuring regulatory compliance, and offering innovative solutions such as automation, risk management, and remittances.

Explore a 360° Analysis of the Market: Unveil the Impact of AI. For complete insights- Request Sample!

Market Challenges

- The integration of advanced IT products and services into Islamic banking systems is a complex process for many financial institutions. While the adoption of new technology can enhance customer service and product offerings, it necessitates specialized training for banking staff. Providing this training is a significant challenge due to the time, cost, and resources required. Failure to adequately train staff may result in misaligned products and a damaged brand image. Moreover, the integration of various systems can be problematic due to the lack of technical expertise within banking firms. This deficiency in knowledge and awareness may hinder the growth of the global Islamic banking software market during the forecast period.

- The Islamic banking software market faces several challenges in the dynamic banking industry. Industry saturation poses competition among software providers to offer innovative solutions to Islamic banks, large enterprises, mid-sized companies, and SMEs. Fintech upheaval brings disruption through fintech companies, pushing for cloud-based solutions over traditional on-premises systems. Islamic finance institutions grapple with automating operations, including smart cards, sukuk issuances, and Sharia compliance, while adapting to regulatory initiatives. Technological advancements like artificial intelligence, blockchain technology, and cloud computing require integration skills. Islamic banks must balance the need for data protection and cybersecurity with the benefits of these technologies. Sustainability and moral investing are also growing concerns. Partnerships with fintech companies and software providers are essential for remaining competitive. Asset administration, risk administration, analytics and reporting, and automation are key areas for improvement. Additionally, retail sector, wealth management, insurance, asset management, remittances, and cellular banking require specialized solutions.

For more insights on driver and challenges – Request a sample report!

Segment Overview

This islamic banking software market report extensively covers market segmentation by

- Application

- 1.1 Retail

- 1.2 Corporate

- 1.3 Others

- Deployment

- 2.1 On-premises

- 2.2 Cloud

- Geography

- 3.1 Middle East and Africa

- 3.2 APAC

- 3.3 Europe

- 3.4 North America

- 3.5 South America

1.1 Retail- The Islamic banking software market is growing steadily due to the increasing demand for Shariah-compliant financial solutions. Banks and financial institutions are investing in advanced software to manage their Islamic banking operations efficiently. These solutions facilitate the implementation of Islamic financing and banking principles, such as profit and loss sharing, riba-free transactions, and ethical investment. The software streamlines processes, enhances transparency, and ensures regulatory compliance, making it an essential tool for Islamic financial institutions.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) – Download a Sample Report

Research Analysis

The Islamic banking software market is witnessing significant growth due to the increasing demand for Sharia-compliant financial solutions. This market caters to the unique needs of financial institutions offering Islamic banking operations, which differ from conventional banking in their rejection of interest-based financing and adoption of profit-and-loss sharing, asset-backed financing, and sukuk issuances. Automation, risk administration, analytics, and reporting are crucial components of Islamic banking software, enabling efficient management of transactions and regulatory compliance. Smart cards, cellular banking, and fintech partnerships expand accessibility to Islamic finance. Cloud-based solutions, artificial intelligence, blockchain technology, and cloud computing are transforming the industry, offering advanced features and enhanced security. Regulatory initiatives worldwide are driving the adoption of these technologies, ensuring transparency and compliance with Islamic finance principles. Software providers and fintech companies are at the forefront of this innovation, catering to the retail sector and asset administration needs of Islamic financial institutions.

Market Research Overview

The Islamic Banking Software Market is witnessing significant growth due to the increasing demand for Sharia-compliant financial solutions. This market caters to the unique needs of Islamic banks and financial institutions, enabling them to automate their operations while adhering to the principles of Islamic finance, which prohibits the collection and payment of interest. Key features of Islamic banking software include asset-backed financing, risk administration, analytics and reporting, asset administration, cellular banking, and integration skills. The market is also witnessing trends such as fintech partnerships, data protection, cybersecurity, sustainability, and moral investing. The market is saturated with on-premises, cloud-based, and hybrid solutions catering to various segments such as Islamic banks, large enterprises, mid-sized companies, retail sector, SMEs, large corporations, wealth management, insurance, asset management, and remittances. Moreover, the market is witnessing the adoption of advanced technologies such as artificial intelligence, blockchain technology, cloud computing, and regulatory initiatives. Fintech companies and software providers are also playing a crucial role in the growth of the market. Islamic banking operations are increasingly relying on cloud-based solutions for their efficiency and cost-effectiveness. Sukuk issuances, smart cards, and other digital initiatives are also driving the growth of the market. However, the market faces challenges such as industry saturation and fintech upheaval, which require continuous innovation and adaptation.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Application

- Retail

- Corporate

- Others

- Deployment

- On-premises

- Cloud

- Geography

- Middle East And Africa

- APAC

- Europe

- North America

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

SOURCE Technavio