A surge in consumer interest for nightlife, fitness and entertainment may indicate less hesitancy among consumers to engage in activities where it’s difficult or impossible to socially distance.

New business openings flatten in Q3. In Q3, new business openings across categories held steady, reaching 142,328 — an increase of 1% YoY.

However, total new business openings for the first nine months of 2021 (439,094) still exceeded pre-pandemic levels for the same period in 2019 (433,243).

Leisure, hospitality and beauty drove new business openings. New business openings in leisure and hospitality on Yelp increased in Q3 2021 compared to Q3 2020, which was to be expected as the vaccine became widely available earlier this year.

In Q3 2021, hotels accounted for 3,514 new openings (up 32% YoY), nightlife saw 2,570 new openings (up 30% YoY) and businesses in the beauty sector grew by 11,029 (up 7% YoY).

New restaurant and food business openings remain steady nationwide. Similar to how new business openings across the board have flattened, new openings of restaurant and food businesses increased by 2% YoY, adding 19,892 new businesses in Q3 2021.

Growth in this category looks different when analyzed at the state level: Numerous states experienced an increase in restaurant and food business openings from Q3 2020 to Q3 2021, including Alaska (up 79%), Connecticut (up 20%), Hawaii (up 19%), Maine (up 57%), Montana (up 6%), New York (up 8%), Rhode Island (up 12%) and Wyoming (up 32%).

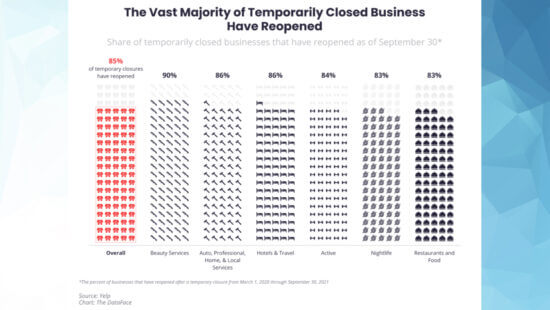

As for reopenings, 83% of restaurant and food businesses that were temporarily closed between March 2020 and the end of Q3 2021 have reopened as of September 30, 2021.

People were very interested in nightlife, fitness and entertainment. In Q3 2020, nightlife businesses in many states were forced to close due to pandemic restrictions. A year later, consumer interest (measured by Yelp through interactions with businesses on its platform, such as viewing business pages, posting photos, reviews, etc.) in this sector has risen substantially — interest in dance clubs (up 67%), piano bars (up 58%), comedy clubs (up 79%), speakeasies (up 80%) and gay bars (up 38%) have all seen an uptick compared to Q3 2020 levels.

Gym and fitness classes experienced a similar surge in interest. In Q3 2021, pilates (up 54%), pole dancing classes (up 56%), aerial fitness (up 74%), yoga (up 41%), barre classes (up 42%) and saunas (up 55%) all surpassed Q3 2020 consumer interest levels.

Additionally, increased consumer interest in bowling (up 116% compared to Q3 2020), waterparks (up 115%), axe throwing (up 107%), stadium arenas (up 96%), indoor play centers (up 204%), laser tag (up 77%) and amusement parks (up 70%) may indicate less hesitancy among consumers to engage in activities where social distancing is difficult or impossible.

Why we care. These statistics give us a general idea of how local businesses are operating and what’s top-of-mind for consumers. Business reopenings have decreased, which may mean that temporarily closed businesses are becoming less common and that local economies are adapting.

While leisure and hospitality drove new business openings, these businesses may still be navigating a labor shortage, which can severely impact the ability to serve customers and undermine marketing efforts. The restaurant and food industry is facing a similar labor shortage, along with rising food prices, which may explain the diminished growth nationwide.

In the nightlife, fitness and entertainment industries, consumer interest has exceeded 2019 levels across the board, save for movie theaters. This shift might be driven by the availability of the COVID vaccine and pent-up demand carried over from 2020 and earlier this year.

These statistics can be interpreted as generally positive, but it’s important to remember that it’s historical data. The pandemic is still here and so are its side effects: Inflation is at its fastest rate in 13 years, there is a labor shortage in certain sectors, mask mandates remain in effect in some states, certain cities have vaccine requirements for indoor businesses and supply chain difficulties are trickling down to customers. In addition, we are approaching the holiday season, which saw a substantial spike in COVID cases last year — business owners and marketers should have a plan in place should history repeat itself.